INSTITUTE OF SOLOMON ISLANDS ACCOUNTANTS MEDIA RELEASE - PROFESSIONAL DIPLOMA PROGRAM GRADUATION 2024

Title: ISIA congratulates graduands of Australia-funded Professional Diploma in Accounting Program.

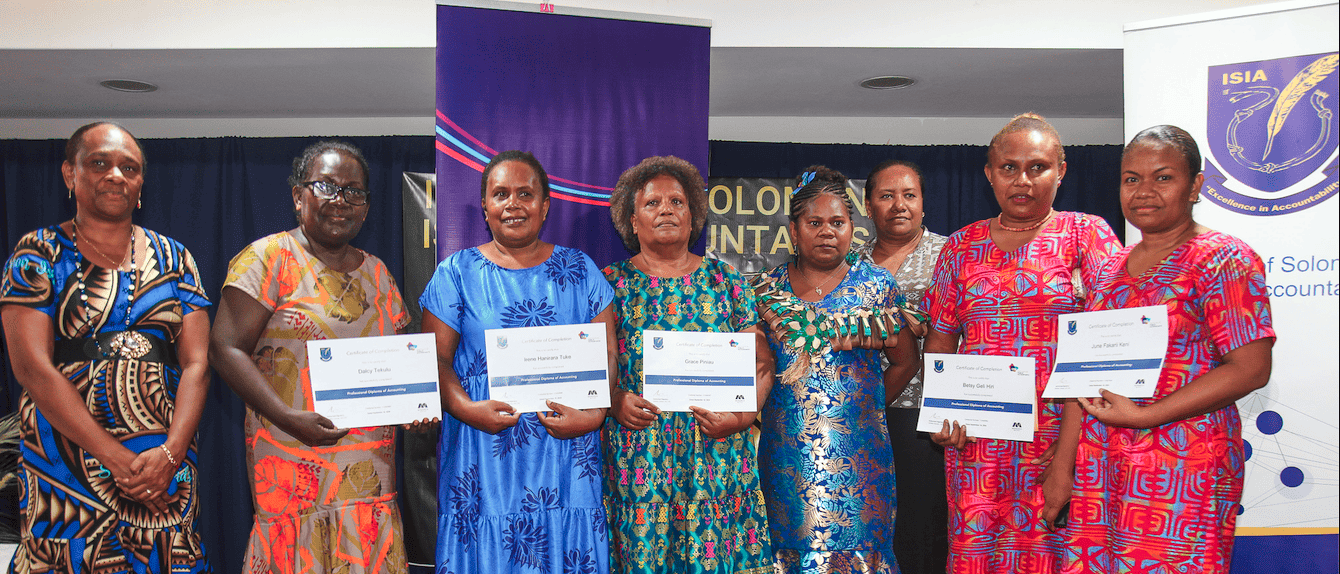

Fifty-two (52) accountants from both the public and private sectors have graduated with a Professional Diploma in Accounting – a professional program delivered by the Institute of Solomon Islands Accountants (ISIA) on 16 th of September.

This graduation ceremony is for the second cohort of students who completed the Professional Diploma in Accounting Program. The first cohort completed the program in 2023.

ISIA, with continued support from the Australian Government, delivers the program in collaboration with the Institute of Public Accountants (IPA), and Monarch Institute.

ISIA CEO, Pamela Naesol-Alamu said ISIA is highly appreciative of both Solomon Islands and Australian governments support in its endeavors to raise the standards of the accounting profession in the country.

“To raise professional accounting standards, we need to develop a pool of highly competent accountants, and professional development programs such as the Professional Diploma in Accounting are aimed at equipping accountants with technical knowledge and enhancing their capabilities to provide high quality services to their employers and clients”.

The program has four modules which covered key accounting competencies that are expected of professional accounting personnel.

This is targeted for technician accountants and registered bookkeepers and includes a Tax & Law module contextualised to the Solomon Islands Tax and Company Law.

Speaking to the graduates, Australia’s Deputy High Commissioner to Solomon Islands, Andrew Schloeffel, said, “Australia is proud to be a long standing supporter of the Institute of Solomon Islands Accountants and to be able to provide scholarships for many of the participants in this course. A strong cadre of accounting professionals including the graduates here today is critical to lifting the standards of accounting across Solomon Islands, fostering good governance, and contributing to sustainable economic growth”.

Institute of Public Accountants Chief Executive Officer, Professor Andrew Conway, said, “Australia and the Solomon Islands are neighbours and long-time friends.

The IPA Group is committed to capacity building in the Pacific region. The IPA Group are proud and value our role as the ISIA’s partner of choice to develop education for the accounting profession in the Solomon Islands.

“I was delighted to be able to attend this graduation and celebrate the achievements of this second cohort of the Professional Diploma in Accounting; a program designed to best practices and aligned to the Solomon Islands taxation and legal framework. This Diploma will position the graduates for successful careers in accounting and drive economic value in the Solomon Islands. I commend the vision of the Institute of Solomon Islands Accountants and thank the Australian Government for their support in this important program and for their continued support for the next cohorts of students”.

ISIA CEO Ms Naesol-Alamu said, “once again it’s been about effective partnerships and collaborations geared to achieve the desired outcomes that are to the benefit of the whole Solomon Islands and those who contribute to its economic growth.”

ISIA intends to provide more professional development opportunities to enhance accountants’ knowledge and skills in the country, and a professional membership pathway for its members to allow them to progress toward higher professional accreditation. Employers in both public and private sectors, business houses and everyone that relies on the services of accountants should support the work of the Institute as Solomon Islands stands to gain many economic benefits with a strong local accounting profession.

End://

For more information, contact ISIA Media on This email address is being protected from spambots. You need JavaScript enabled to view it. or call 20131